It’s the day before production, and your team is finalizing all the little details. Your Director of Photography is picking up the camera package, Locations is finalizing city permits, Transpo is getting your rental van, and you’re submitting the final paperwork for SAG. Suddenly, everything grinds to a halt when all four of them tell you they will need a certificate of insurance in order to proceed.

If you don’t have one, you’re stuck, and your film is dead in the water until you can prove that you have insurance to cover rentals, health and well being of your crew, or whatever the case may be. Or maybe you do have a certificate of insurance but your vendor tells you they require more coverage than you currently have. In either case, you’ll need to reach out to an insurance broker in order to protect your crew, vendors, and yourself.

A certificate of insurance, or COI for short, is proof that you have insurance coverage should the worst happen. It’s essentially a list of your production’s insurance coverages, as well as the effective dates and limits of each coverage.

Every COI is is custom-made, written for a particular “certificate holder” (your rental house, location, etc.), and contains a box at the bottom where your insurance broker can include any specific language that your certificate holder requires.

Beyond coverages, every certificate of insurance contains your company’s name and address, your insurance broker’s contact information and signature, as well as the name and national identifier number of the insurance company backing your production.

A COI proves that your production, no matter how big or small, has the backing of a licensed insurance broker, as well as large insurance companies ready to step in if something goes wrong.

You need a COI because your production insurance policy doesn’t just cover you, it may cover other people and organizations affected by your production.

Some coverages are very specific about what they cover, and who requires them. This is the case with many of your Inland Marine coverages, like Rental Equipment (equipment rented from others) and Auto Physical Damage (damage to your rented vehicles). If a camera breaks, or your driver gets in a fender bender, your production’s insurance policy protects you as well as the rental company, enabling them can have their property repaired or replaced.

Because of this dual-protection, an equipment rental house or rental car agency will likely insist on having a certificate of insurance before they allow you to take out your rental.

Other coverages protect far more than just the property on your film set.

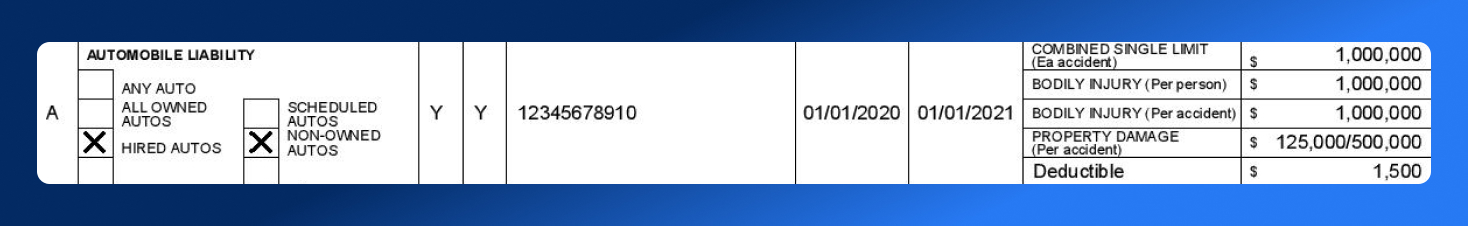

This is the case with any of your Liability policies – General Liability, Auto, Excess, and Workers Compensation. These provide coverage in the case that third parties are affected by your production, whether the pizza boy breaks his arm while delivering your crew lunch, or medical expenses for a the other driver when the production van gets into a wreck, or covering the health and well-being of your crew during the everyday risk of film production.

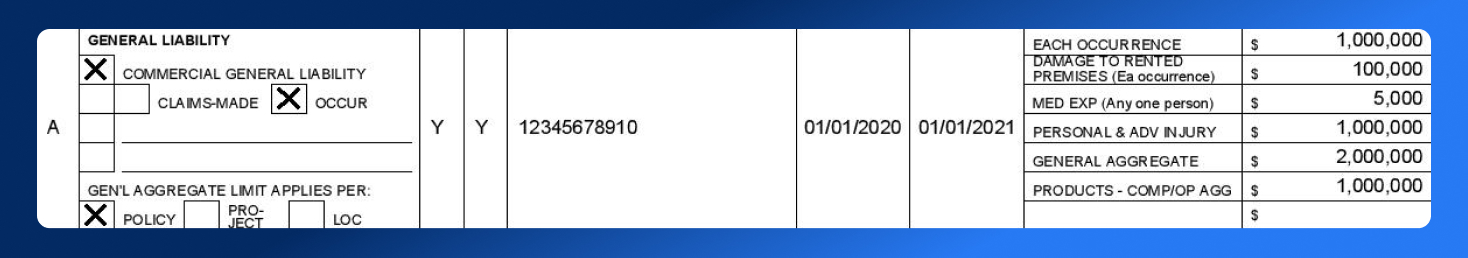

These coverages start their limits in the millions of dollars, and provide far-reaching coverage for lawsuits and other losses. Because of this, certificate holders almost always require General Liability, and often multiple other liability policies.

In sum, a certificate of insurance protects both you and your certificate holders. It proves that, if you needed to file a claim, you—in collaboration with an insurance company—have the resources to meet that claim, protecting your production company from potential financial ruin. It also promises your certificate holders that if there is a claim, they can count on receiving compensation for their losses.

Hopefully you won’t have a claim, of course; but if you do, a COI gives you and your collaborators confidence that your losses will be covered.

In addition to the contact information for your production company, insurance broker, and insurance company, a typical production insurance policy has five different coverages. Also, at the bottom, there is an important box marked “Description of Operations.”

You may have all five of these coverages, or you may have one or two of them as fits the needs of your production. You can learn more about each of the coverages in our Essential Guide to Production Insurance, but here’s a brief description of each:

General Liability covers third parties affected by your film, as well as some basic lawsuit coverage. This is the backbone of production insurance policies.

Inland Marine covers damage to property, including Rental Equipment, Auto Physical Damage, and Third Party Property Damage (covers damage to your rented locations). This is required by equipment rental houses, and, if not required, is highly recommended for your locations and auto rentals.

Auto Liability covers property damage, medical expenses, and some lawsuit coverage in the case of accident by one of your rented autos. Also offers some additional “non-owned” insurance for employees driving their own cars on production business.

Workers Compensation Liability covers your employees in the case of work-related injury or illness. This is mandatory in many states. Unpaid volunteers are covered by many Workers Comp policies, but if they are not, insurance companies offer a similar coverage called Volunteer Accident.

Excess Liability is simply additional liability coverage on top of what you already have. It goes up by the millions.

If you’ve met all of your certificate holder’s coverage requirements, they may also ask for some required language in the Description of Operations box.

Sometimes a certificate holder wants more information about their business listed than would fit in the small “certificate holder” box that holds their name and address. The San Francisco Film Commission, for example, asks for the Description of Operations to list “The City & County of San Francisco, its officers, agents, and employees,” in order to be clear about the many entities within the city and county that are referred to in the COI.

Other times, your broker may list additional information that doesn’t fit elsewhere on your COI, like deductible amounts, or coverages like Volunteer Accident.

Many certificate holders require specific language on the COI to show how they are covered by the policy, in the event of a claim. These are very important, and an issue warranting their own section.

These phrases, if required, are some of the most important features on your certificate of insurance. They illustrate how your certificate holders are covered by your policy. These phrases are so important that often a certificate holder will reject the COI unless it is worded exactly as they require.

But what do they mean? Here’s a primer:

This corresponds to your General Liability coverage. It covers your certificate holder under your policy if they are sued for your actions.

This corresponds to your Inland Marine coverages. Equipment rental houses and locations often require it, because it means if their property is damaged in your care, they are entitled to be paid back by the insurance company.

This is an additional level of coverage on General, Auto, and Workers Comp Liability policies. It means that if your production is sued, a lawsuit must stop with your production’s insurance policy and cannot extend to the municipality, rental house, or anything else. An alternate wording of this is “insurance is primary and non-contributory”. If you see this on a list of insurance requirements, you need a Waiver of Subrogation.

Some certificate holders require an additional level of coverage called an Additional Insured Endorsement. This is a separate form, often submitted with your COI. This form officially adds the certificate holder to your insurance policy by name, and goes on file with the insurance company. Your insurance broker can help you with this easily.

Most production insurance policies have Blanket Additional Insured coverage, meaning your production company can have as many additional insureds as it needs. If you see some strange wording, and you want to know what it means, ask your insurance broker!

There’s few things more frustrating than having your camera package held up because you don’t have all the coverage the rental house requires.

The easiest way to avoid this is to send your insurance broker any insurance requirements that you need to meet. These are usually available on the website of your rental company or municipality, and if not available online they likely have a form with all the requirements listed. Once you send the requirements to your broker, your broker can then tailor a policy to match your needs exactly so you avoid any annoying holdups.

But what about if your policy is already bound? That’s easy too!

Send whatever insurance requirements to your broker and he or she will work with the insurance company to “endorse” your policy. Your broker will get you a quote for what it will take to meet the insurance requirements, and if you approve of the quote, your broker will place your payment and raise your coverages up to the required limits. Then they will send you a COI reflecting the new limits and you’ll be good to go.

Sometimes you have all the required coverages, but your certificate holder wants it to read a little differently. If this is the case, send their requests to your insurance broker and he or she can make whatever adjustments are needed.

Ask your insurance broker.

Some providers of production insurance have an online system where you can create the majority of your own COIs, provided you have the required coverages. In these systems, you can input your certificate holders’ names and addresses, as well as choose from all of the standard language corresponding to your coverages. If you encounter anything you are unable to do yourself, contact your broker and they can write one for you.

If you're still unsure, try Wrapbook's quote builder tool to see exactly what you're working with.

Other production insurance providers do not have this option, and so your insurance broker will create the COI for you. In this case, send your broker the certificate holder’s name and address, as well as any specific language they require, and your broker will turn it around ASAP.

Once you have your certificate of insurance, you can rest easy before, during, and after filming. If you're using Wrapbook, you can easily add your COI before you onboard cast and crew.

In Wrapbook, uploading your COI is a must to protect you and your production long before you onboard or run payroll.

Having a certificate of insurance handy can often resolve most insurance-related problems. However, there are a few pitfalls producers can fall into rendering them less effective.

This results in production delays and unexpected costs when filmmakers and brokers have to scramble to meet the basic criteria for rentals, permits, etc. Informing your broker up front enables him or her to tailor a policy that meets your requirements exactly.

Your production is probably renting equipment because it is much more expensive to buy it. Remember to ask your rental company for the replacement cost of their equipment, so you can be covered properly in case of a loss.

Many filmmakers forget that their rented equipment coverages need to start when they pick up the equipment and end when they drop off the equipment, resulting in lost time while the broker endorses the policy.

Your insurance broker may be working at midnight, but insurance companies work during standard business hours. If you need increased coverage, you will have to wait for the next business day for it to be processed.

At Wrapbook, we were producers and assistant directors before we became insurance brokers. We come from film, and we love films and filmmakers.

When it comes to certificates of insurance, we want both you and your certificate holders to feel comfortable in your coverage, should a loss ever occur. We need to know whatever requirements you need to meet in order to create the best COIs for you. Contact us or reach out to insurance expert adam@wrapbook.com with any questions.

At Wrapbook, we pride ourselves on providing outstanding free resources to producers and their crews, but this post is for informational purposes only as of the date above. The content on our website is not intended to provide and should not be relied on for legal, accounting, or tax advice. You should consult with your own legal, accounting, or tax advisors to determine how this general information may apply to your specific circumstances.