At Wrapbook, we pride ourselves on providing outstanding free resources to producers and their crews, but this post is for informational purposes only as of the date above. The content on our website is not intended to provide and should not be relied on for legal, accounting, or tax advice. You should consult with your own legal, accounting, or tax advisors to determine how this general information may apply to your specific circumstances.

If you’re wondering how to run film production payroll, you’ve come to the right place.

However, please note that this is not a step-by-step guide. Some of these tasks can be performed simultaneously, while others must be managed over the entire course of a production. Exactly how to manage your payroll will depend on the circumstances unique to the film you are working on.

To start, you’ll want to get set up with the right payroll company. These organizations are essential because they handle tasks that would otherwise be a huge burden to an individual managing payroll on their own.

Wrapbook is purpose-built for film and TV and acts as a force multiplier for your production team. With digital onboarding, union compliance, real-time reporting, and intuitive tools to manage your entire payroll lifecycle, Wrapbook empowers confident and collaborative decision making.

Plus, it’s backed by entertainment and labor experts who know how to run film payroll.

Early in pre-production, you’ll also need to secure the right production insurance.

Many production insurance companies limit their offerings to workers’ comp, forcing you to work with a separate insurance company to meet the rest of your coverage needs. Wrapbook provides full production insurance packages, including general liability and more—all managed through a streamlined digital dashboard.

To get a quick estimate for your production, check out our intuitive quote builder.

Using Wrapbook’s free payroll calculator to estimate crew costs, union fringes, and tax obligations helps you budget accurately up front in order to avoid overages later.

Learning how to run film payroll means mastering onboarding; or the process by which productions officially hire their personnel.

This is when you collect and organize startwork documents from each of your crew members, enabling your production to pay them in full compliance with tax law. The process breaks down into a few essential tasks.

When onboarding your team, it’s crucial that you correctly identify whether they’re an employee or a contractor.

The difference between the two is important for compliance with U.S. tax and labor regulations. Misclassifying either worker type is one of many expensive mistakes, resulting in fines and other costly consequences that will impact your project’s budget.

Most business silo wages for employees and contractors into completely different payment systems, ensuring safety through separation. Film productions, by contrast, must integrate separate processes for paying employees and contractors into a single system.

This makes it even more critical for productions to understand the worker classification requirements in each state.

The heart of onboarding is gathering startwork documents. These documents are key to running payroll in full compliance with the law.

Exact startwork requirements will vary from state to state, but a typical startwork packet will include some combination of at least the following documents:

Wrapbook’s digital startwork automatically streamlines critical onboarding documents and associates them directly with individual workers, making this process faster, easier, and more secure than doing it by hand.

Wrapbook makes record-keeping easier than ever.

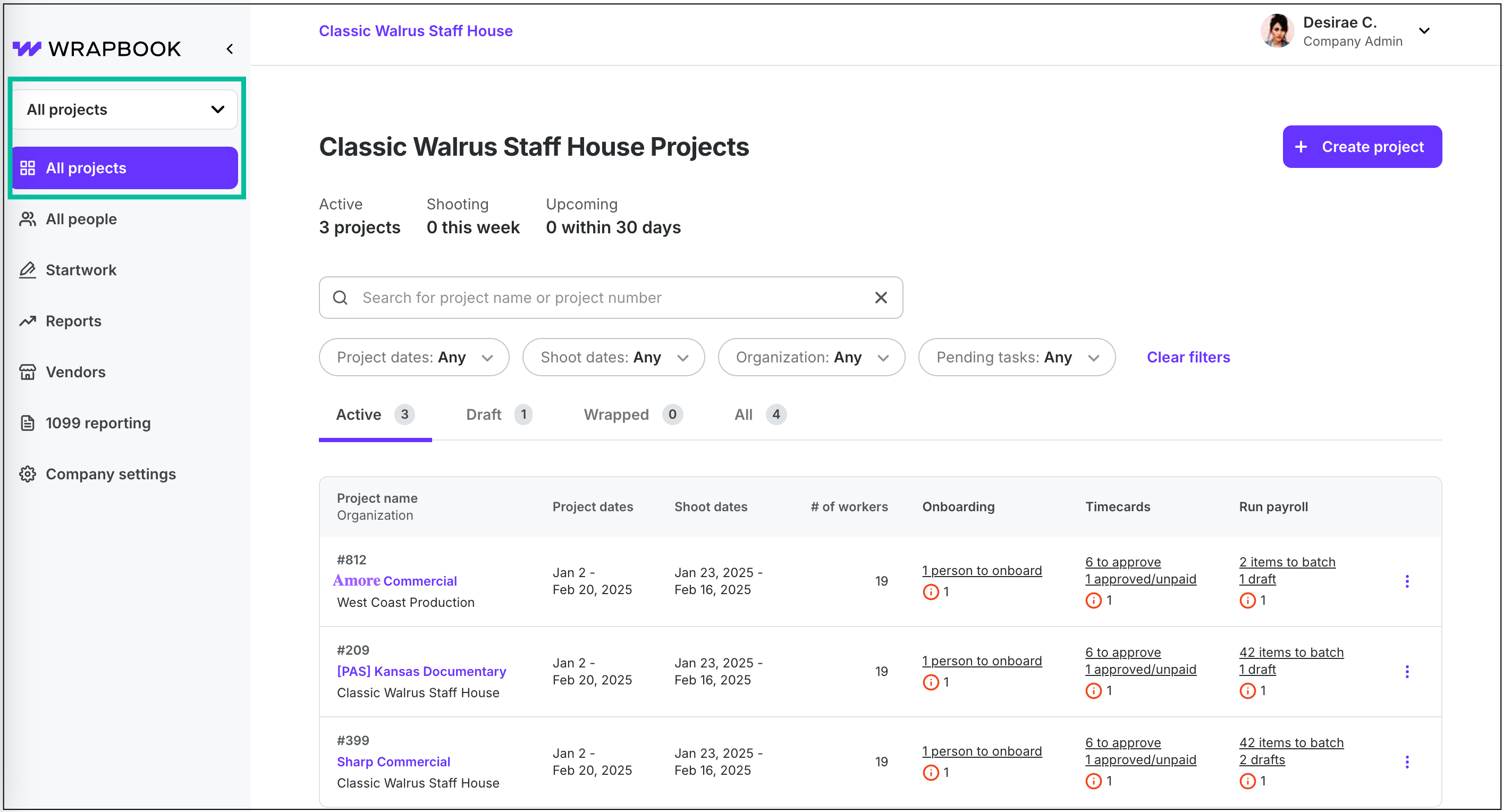

Documents are automatically saved, organized, and searchable from the moment they’re submitted into your production company’s centralized dashboard.

Workers can likewise enjoy increased organization, with documents such as their own W2s being sent directly through Wrapbook.

Wrapbook brings all of these features together to form a power production management tool that revolutionizes the onboarding process. With Wrapbook, you can experience onboarding the way it was meant to be.

As each pay period draws to a close, productions must collect timecards from their crew. Physical timecards force a messier-than-necessary workflow and are vulnerable to damage, loss, and general disorganization.

This is why digital timecards are now the industry standard. Wrapbook’s platform catches math errors, tracks overtime, and integrates with union rules automatically.

If a mistake is made, Wrapbook’s timecard management tools enable teams to perform corrections quickly and without holding up an entire payroll batch, ensuring that your payroll runs seamlessly under any circumstances.

Once timecards are collected, production teams must begin the work of processing them. That’s why one of the most essential skills for processing timecards is simply knowing how to calculate hours worked. It might seem basic, but mistakes are made more often than you’d think.

When mistakes are made during work hour calculation, productions pay the wrong wages to their employees. If the wages are too little, you have an understandably angry crew and a problem that needs to be fixed ASAP.

If the wages are too much, you have an unnecessary expense, a potential budget overage, and not a lot of options for rectifying the situation.

Wrapbook takes the headaches out of timecards with real-time hours-to-gross wage calculations, automatically tracking gross and net pay as well as any deductions. Wrapbook has built-in SAG-AFTRA compatibility and can even automatically calculate select IATSE and Teamster timecards.

Once you’ve reviewed your timecards, it’s time to officially approve them. If you’re learning how to run production payroll, you might be surprised how clunky and time consuming the process can be. With a traditional service, you’ll start by sending them a batch of timecards, usually via email or a proprietary online system. You then have to wait for a paymaster from the company to approve your timecard batch.

Paymasters are busy and may not get back to you right away. When they do respond, they may discover an error.

In that case, they’ll send the entire batch back for editing, even if the issue is on a single timecard. Your team will have to correct the problem and resubmit the entire batch. This process will repeat until, eventually, the paymaster approves your batch and starts paying your crew.

Wrapbook scraps the typical timecard approval process and replaces it with a workflow better suited for the modern production environment.

With Wrapbook’s flexible approval workflows, your team can edit, decline, or approve as many timecards as you need, when you need to.

Tax and labor regulations can vary dramatically from place to place.

To avoid legal landmines, productions must maintain compliance at the federal, state, and local levels—all at the same time. Laws are always changing and it’s on your production to stay up to date.

Production teams must thoroughly check each timecard and payment to make sure it adheres to laws regarding overtime, meal breaks, and minimum wage.

The good news is that compliance is the bread and butter of the best entertainment payroll companies. It’s their job to remain as in-the-know as possible about any regulations that might affect you and ease the burden on your production.

Wrapbook is built to keep your production confidently compliant. Whether you’re paying union or non-union workers, Wrapbook is kept up-to-date with the latest regulations, keeping your production in good tax standing with as little effort as possible.

Once timecards are approved, the moment to disburse payments arrives. If a production company plans to handle every step on its own, they’ll have to physically issue and send payment to each member of the cast and crew.

This is time-consuming, so be sure to plan ahead and submit payments within your state’s pay period requirements.

Wrapbook takes this off your plate. Whether you’re sending checks or making direct deposits, producers can run batches with the click of a button and monitor payment statuses through the platform.

Wrapbook supports both direct deposit and physical checks, with automatic notifications sent to cast and crew. Workers can view payment details, download W-2s or 1099s, and track their earnings all in one place.

Producers need access to real-time data to make decisions on the fly. Whether you’re reviewing fringe costs or reconciling a payroll run, visibility is key.

Wrapbook offers a suite of customizable, on-demand reports that provide real-time insights into every aspect of your production’s finances. Whether you’re tracking labor costs, vendor payments, union fringes, or payroll taxes, Wrapbook’s all accessible, on-demand reporting tools are designed to support you through prep, production, and post.

Productions must handle federal, state, and sometimes city-level tax withholdings, filings, and payments. Making a mistake can result in penalties and tax audits, which means knowing how to calculate payroll taxes is an essential skill.

Wrapbook conveniently automates all payroll tax processes. From IRS filings to local city compliance, we manage calculations, filings, payments, and year-end forms like W-2s and 1099s. Your team stays compliant without lifting a finger.

Mastering how to run production payroll is critical to the success of any production. With the right system, you can save time, reduce risk, and pay your cast and crew accurately.

Wrapbook is modern payroll, built for the future of production. From onboarding and insurance to tax filing and payments, everything happens in one place—faster, smarter, and made for how crews work today.

Schedule a demo to see how we can help your next production run smoother than ever.

Running payroll on a film production isn’t just a to-do list item—it’s a legal and financial imperative. From onboarding workers to managing union rules, state tax codes, and timecards, managing a film’s payroll is a uniquely complex challenge compared to other industry jobs.

This practical guide teaches you how to run film payroll, with real-world steps to help producers and production managers stay compliant, avoid fines, and pay your team on time.

Film production is a unique industry. Therefore, learning how to run film payroll is a unique and complex task.

Let’s start by talking about three characteristics that make it different.

Most businesses pay the same employees week after week and can rely on long-standing payroll paperwork to keep the machine running. But that’s not how to run cast and crew payroll.

In film production, workers assemble temporarily and disband once production wraps. That means payroll starts anew for each and every project.

And for independent films, it often means incorporating a new production company for each new project.

Running film payroll means juggling rules from SAG-AFTRA, IATSE, the DGA, Teamsters, and more—each with unique wage scales, overtime policies, and startwork requirements.

If you’ve never wondered how to run film payroll before, you might be surprised at how many regulations have to be kept in mind at the same time. And union rules are just the beginning.

Traditional businesses are static, based in one place , governed by one set of tax and labor regulations. Film productions, however, often shoot in multiple states over the course of a project, which means keeping track of each state’s overtime laws, wage notice requirements, startwork, and more.

Productions must simultaneously manage each state’s regulations adding an additional layer of complexity to an already complex process.